Introduction - Week 1 Flashcards

Some pearls of wisdom about theories and models:

- The purpose of theory is to predict and explain. A theory is not tested by the reasonableness of its assumptions but by its ability to predict accurately and explain.

Attribution Unknown

- A model is to be used, not to be believed.

Milton Friedman

How can I know if a theory is good or bad ?

- A theory is good if it matches the real world well

- A theory is bad if it matches the real world poorly

It is necessary to have a fair degree of skepticism regarding theories in general: they are not the truth and what works today might not work tomorrow..

Random variables and probabilities :

Risks and gambles are central to theoretical and practical finance. We will, therefore, rely on tools that describe gambles.

Random variables and possibilities outcomes Setup:

Consider a random variable Xi ;

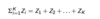

Summation: if you want to write the sum of Zi where i runs from 1 to K, we have;

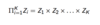

Product: similarly, if you want to write the product of Zi where i runs from 1 to K, we define;

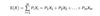

What is The expected value or mean of X ?

(Def. + Formula)

Its probability-weighted average

The mean measures the “average” outcome from a gamble or variable.

Why is the expected value or mean important for companies and investors?

- Investors are concerned with mean returns from portfolios.

- Companies care about expected values of cashflows from investment projects.

The variance of a random variable measures …

The (probability weighted) dispersion of the outcomes around the mean.

The more (less) spread out a variable’s outcomes are around its mean, the larger (smaller) the variance.

Formula of the variance:

Why is the variance important for investors?

Investors care about the variance of portfolio returns (as this is a measure of portfolio risk).

- The less spread out a variable’s outcomes are around its mean, the smaller the variance. Therefore, the ROI amount will be around the expected value of the mean. Investors know what they’ll get. Fewer risks.

- The more spread out a variable’s outcomes are around its mean, the larger the variance. Therefore, the investors can expect higher returns (far above the mean) but also smaller return or losses (far under the mean). More risks.

What is the Discount Rate?

Interest rate used to compute present values of future cash flows

What is the Discount Factor?

Present value of a $1 future payment

What is the Present Value?

Value today of a future cash flow

What is the Future Value?

Amount to which an investment will grow after earning interest.

A discount rate is…

The reward that investors demand for accepting delayed rather than immediate gratification.

The discount rate is also called:

- Interest rate

- Required rate of return

- Opportunity cost of capital.

What is the discount rate in real life?

- If you lend someone money for a year, you demand interest as you cannot instantly spend the money you have lent on consumption goods.

- If you lend money to a less trustworthy person/company, you require a greater interest rate as you’re less confident that you’ll get your money back.

- The discount rate is also called opportunity cost of capital because it is the return foregone by investing in a capital project rather than investing in freely-available securities.

How many varieties of interest calculation are there?

2

Simple and compound interest.

What is the simple interest?

The interest earned or paid is just the original balance of the deposit/loan (X) times the interest rate (r).

So over T periods, the total balance of your deposit/debt will grow to be: X + r × X × T =

X (1 + rT ).

What is the Compound Interest?

Interest must be paid on previously charged/earned interest.

So over T periods, the total balance of your deposit/debt will grow to be:

X(1+r)T

r=interest rate

T=time

Compound versus simple interest at 10% per annum :

Clearly: compound interest is good for savers (bigger sum earned) but worrying for borrowers (higher monthly/annual payments)

What type of question asks for the future value of X, assuming an interest rate of r and an investment period of T ?

We are given a cashflow of X today. What value will this cashflow grow to if invested at interest rate r for T periods?

FV (r,T) = X (1 + r )T

- Obviously, the future value is larger if r is larger

- The future value is obviously also greater when T is greater or when X is greater.

Future value: example