Topic 13: Risk, Portfolio Diversification & Shocks Flashcards

Demonstrate on a graph how diminishing marginal utility causes risk aversion. Show the price this agent would be willing to pay for insurance that eliminates risk.

Due to the concave shape of the utility function U(Y), the expected utility from a 50% lottery (with Y0-u Y0+u as prizes) is only U(YC) (the average of U(Y0-u Y0+u)). This is lower then the utility recieved from the average income (E(Y)), Y0.

As a result, consumers would be willing to pay up to Y0+u-YC in the good years for insurance that bumps income to YC in the bad years, where YC-Y0 is the risk premium, or a monopolostic insurers profits.

How can we measure the risk aversion of a utility function?

With the arrow pratt coefficient of relative risk aversion R(Y) = -Y U’‘(Y)/U’(Y).

A unitless parameter that changes along the utility function as Y increases. Zero for a straight line as U’‘(Y) = 0.

With what formula can we calculate U(YC), gained from a taylor expansion?

U(YC) = EU(Y) ~= U(Y0) + 1/2u2U’‘(Y0)

(where u is the deviation of the lottery outcomes from the expected outcome).

With what equation can we approximate the risk premium?

How about Py/Y0

p ~= 1/2u2U’‘(Y0)/U’(Y0)

py/E(Y) ~= 1/2R (SD(Y)/E(Y))2

p/E(Y) ~= 1/2RσY2

Where σY is the coefficient of variation.

Following from ρ/E(Y)~= 1/2RσY2

Give the equation for YC

ρ/E(Y) = 1/2RσY2

ρ=1/2RVar(Y)/E(Y)

Yc = E(Y) - ρ

YC= E(Y)-1/2RVar(Y)/E(Y)

How would be describe the risk adversness of R = 1, 2 & 4?

R=1 - Very lightly risk adverse.

R=2 - Risk adverse.

R=3 - Very risk adverse.

What is the equity premium puzzle?

The risk premium on private assets (relative to government debt) is much larger then would be expected given an R value of 2 - calculated from psychological experiments.

How might we explain the equity puzzle?

- It is possible that the estimates of R=2 don’t scale up from the low lotteries used in the experiments to the volumes of the lotteries in finance.

- Portfolio holder idiosyncratic risks -enemployment, credit constraints mean a higher value on liquidity

- Imperfect imformation, makes prices more volatile, which seems to suggest risk aversion.

- Narrow framing- households focus on one risky venture at a time, and don’t see the gains from diversification.

- Loss aversion - aversion to downside risks is disproportionately high.

A household has assets of 2mil, that if invested in teasury bonds guarentee a 5% return. Alternatively, an investment in stocks gives the following schedule of returns. Given R = 2, calculate the certainty equivilent of the stock investment and indicate the housholds choice of asset.

Rate of Return | Probability

4% | .25

5% | .25

- 5% | .25

- 5 | .25

First, calculate the actual returns

YTbond=100000

80000, 100000, 110000, 150000

E(Ystocks) = 110000

SE = sqr(Var(Ystocks)) = sqr(Sum(p(Yi) x (Yi-E(Y)2 ) = 25495

Coefficient of variation = 25495/110000=0.232

p/E(Y) = .5RσY2 = 0.2322=5.37%

p = $5909, YC= $104091

Consider a household that allocates wealth between portfolios such that it’s income is determined from the following equation.

How is the variance of the portfolio calculated?

What if the portfolio is just two assets, with the same E(r) & variance?

Var(X + Y) = Var(X) + Var(Y) + 2Cov(X,Y)

Given a two asset portfolio where E(ri) & Var(ri) is identical:

Find the optimal portfolio, and it’s variance.

To maximise, we set dsy2/dλ=0

0=s2(4λ(1-ρ)-2(1-ρ))=4λ(1-ρ)-2(1-ρ),

4λ=2, λ = .5

so sY2= s2(1+ρ)/2

Note that if ρ < 1, then sY2 < s2

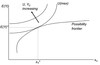

Show how a portfolio with two assets, one riskier and with a greater return then the other can be constructed, with regards to E(Y) and sY

From = E(Y)-1/2RVar(Y)/E(Y)

How can we construct a utility curve (where U(YC))

We must keep YC constant.

So we rearrange so that

E(Y) = Yc + RsY2/2E(Y)

We can then conclude when sY increases, E(Y) must increase. We can then graph

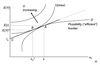

How can we construct our portfolio possibility frontier when we have two assets, and an additional risk free low return asset. Give equations that show the return on the portfolio.

E(Y) = λrs + (1 - λ)rr where rs = safe return rr = risky return

sy = (1-λ)sr

We can then subsitute for lambda, so we get

E(Y) = rs + sy(rr - rs)/sr

We might consider the sr of the utility maximising portfolio without the safe asset. Then the above linear equation is our new portfolio frontier.

Show the effects of a shock that aligns (correlates risk), given a risk free asset.

ρ goes up, so (see graph)

Importantly, this recessiony shock causes a move to T bonds, big flight from the private investment market.