Quantitative Methods 1 Flashcards

(60 cards)

Required rate of return/interest rate

Future Value

Calculating stated (nominal) and effective rates from periodic

Computing effective rates from periodic rate

Future value formula with more than one compounding period

FV/PV based on continuous compounding

PV of a perpetuity

Annuity Due

Payments paid at the beginning of period

Ordinary annuity

Cash flows made at the end of each period

Nominal Scale (4th strongest)

Data is only categorized

Ordinal Scale (3rd Strongest)

Data is categorized and ranked

Interval Scales (2nd Strongest)

Data is categorised, ranked, and evenly spaced

Ratio scales (1st Strongest)

Strongest level of measurement. Categorized, ranked, evenly spaced, natural zero

Steps to producing frequnecy distribution

- Sort data into ascending order

- Calculate range of data

- Decide on number of intervals (k) and interval width (Range/k)

- Determine intervals by successively adding width to minimum value

- Count number observations falling in each interval

- Construct a table showing number of observations falling into each interval

Cumulative frequency

Absoluted frequencies added up as we move from first to last interval

Relative frequency

Absolute frequency of each interval divided by total number of observations

Cumulative relative frequency

Adds up relative frequencies as we move from first to last interval. Fraction of observations that are less than upper limit of each interval

Histogram

Graphical presentation of absolute frequency distribution

Frequency Polygon

Graph midpoint of each interval on horizontal axis and absolute frequency on vertical; draw a line graph

Geometric mean

Mean absolute deviation

Variance

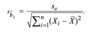

Standard deviation/Varaince calculator

Quartile calculation