Derivatives Flashcards

(38 cards)

Delta

Sensitivity of option value to change in underlying price

can be seen as a slope of a line plotting the value of hte option against the underlying price

positive for long calls, negative for long puts

|Delta| for one option varies between 0 and 1

More OTM = closer to 0

More ITM = Closer to 1

ATM = around 0.5

underlying itself (or a future or forward on the underlying) has a delta of 1

Gamma

change in delta per +1 change in underlying stock price

positive for long calls AND long puts

greatest when ATM, and close to expiry

can be seen as the CURVATURE of a line plotting the value of hte option against the underlying price (vs. Delta, which is the slope of the same line)

Position Delta

net delta of a position (sum of deltas of all constituents, careful of plus or minus)

eg for a covered call:

own one stock and one stock worth of call

net delta is 1 - call delta

it’s “ 1-“ bc delta for the underlying itself (and futures and fwds) is +1 if you’re long, and -1 if you’re short … the delta of an underlying is obviously 1

Protective put:

1 - absolute value of the put delta (just because long puts have negative delta)

effective of an option reduces delta below 1

a delta-netural position is constructed to have total delta of zero, no net exposure to the underlying

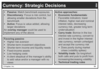

Calls Basics

Long call = unlimited potential profit

Short call = unlimited potential loss

Puts Basics

max profit = breakeven price

breakeven when value = premium paid, when stock price = strike - premium

Protective Put

long the underlying, buy put

buying downside protection

unlimited upside

equivalent to synthetic long call

Covered Call + its applications

long underlying, sell a call

limited upside, most of the downside remains

receive option premium

Applications:

Yield enhancement –> calls OTM, hope that options expire OTM and keep premium

Reducing a position at a favorable price –> happy to sell the stock –> calls ITM, so likely stock will be sold

Target price realization –> calls marginally OTM –> you think stock worth a bit more than current price, happy to sell at slightly higher price

Collar

combo: own the underlying, buy put on lower strike, and sell call on higher strike

Buying downside protection PLUS selling off upside

net premium could be a pmt (debit) or receipt (credit)

limits exposure to the range btwn the two strikes

zero-cost collar = strikes selected so that premiums net to zero

Straddle

(and reverse straddle)

(Long) Straddle = buy call + put @ same strike –> profit from high volatility –> ideal when you expect large movement but dont know which direction

Reverse Straddle = sell call and put @ same strike –> profit from low volatility –> ideal when you think prices will be stable, minor moves up or down

2 breakeven points

Disadvantage: more up-front premium (have to pay for both call and put)

Advantage: max loss = premium, benefit

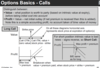

Bull Spreads

General spread info:

memory trick: BUY LOW SELL HIGH

both the same type of option (eg buy low call sell high call)

Spreads = buy and sell equal # of options –> limited upside and downside

Money Spreads = options have diff strikes (but same underlying and expiry)

Debit spread = you pay more than you get in premiums

Credit Spread you receive more than you pay in premiums

Bull Spread = buy a low strike option and sell a higher strike option; profit if the underlying rises

pay more for low strike than you get for selling high strike for bull call (debit spread); for a bull put you receive more (credit spread) for selling the lower strike than you do to buy the higher strike, so you get a net INFLOW of premium

max loss = net premium

limited upside

both Bull call AND Put spread = buy low strike and sell high –> bull put means you’re long the put

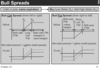

Bear Spreads

General spread info:

Spreads = buy and sell equal # of options –> limited upside and downside

Money Spreads = options have diff strikes (but same underlying and expiry)

Debit spread = you pay more than you get in premiums

Credit Spread you receive more than you pay in premiums

Bear Spreads = Sell LOWER strike, buy Higher strike –> they’re just short bull spreads –> profiles are just reflections in the x-axis (flip over like turning back a page)

NOTE: If a question is ambiguous, use CALLs for BULL spread and PUTS for a BEAR spread

The Greeks: Delta and Gamma

The Greeks: Theta and Vega

Position Deltas

Delta of a Covered Call

Covered call = long underlying, sell call

Call Values Pre-Expiration

Put Values Pre-expiration

Delta of a Protective Put

Hedging a Short Position

Calendar Spreads

FOCUS ON WHERE YOU BENEFIT (in terms of underlying and volatility moves)

Long = buy a longer-dated option and sell a shorter-dated option at the same strike and underlying

Short = sell longer dated and buy shorter dated

both options the same (either two calls or two puts)

How to tell if you should be long or short: at expiry of the nearer-dated option, both will have the same intrinsic value, which cancels out (bc we’re both long and short) BUT the LONG position will also still have time value –> as long as time value > initial net premium paid, you gain

SO:

go LONG if close to or at ATM and expecting low price movement between now and the shorter-term expiry

go SHORT if expecting a big move in the underlying or a decrease in implied volatility

–> if your LT view on value of stock is bullish, want long call spread

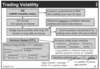

Volatility Skew and Smile

two common observed patterns

Smile = further-from-ATM options have higher implied volatilities –> imagine plotting implied volatility vs. strike –> you’d see a u-shaped curve (smile)

Skew = implied volatility increases for more OTM puts, and decreases for more OTM calls –> more common than smile

–> because in a bear scenario, more demand from hedgers for OTM puts to protect their downside, bidding up value and therefore implied volatility

–> if you see a sharp increase in the level of skew plus a surge in implied volatility, means mkt is turning bearish –> little demand for OTM calls (hence why DECREASE in OTM call vol)

HOW TO PROFIT FROM IT IN PHOTO:

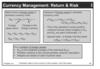

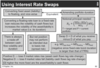

Interest Rate Swap Notional Principal Formula

MEMORIZE FORMULA AND BOTTOM BOX OF SLIDE (positive D etc)

used to amend portfolio duration

Ns = notional swap principal

MDt = target MD

MDp = current portfolio MD

MDs = MD of the swap

MVp = MV of portfolio

SWAP DURATION = net of the MDs of equivalent positions in fixed-and-floating rate bonds

–> D or what you receive minus D of what you pay –> eg MDpayfixed = MDfloat = MDfixed –> negative bc fixed bond duration > that of FRN

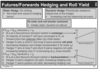

How to Hedge against ST Interest Rate Changes

for futures: if fear rates will rise, then quote will fall, so hedge by selling futures (sell high, buy cheap, if rates do rise)

–> # of contracts for hedge = principal for actual loan / reference deposit

Fixed Income Futures

FI:

changes in the price of a FI future are driven by changes in the TD bond price –> work in terms of BPv

NOTE: DONT FORGET to MULTIPLY BY CONVERSION FACTOR