Derivatives Flashcards

(55 cards)

Describe how the value of a European option can be analyzed as the present value of the option’s expected payoff at expiration.

Describe how a delta hedge is executed.

Calculate and interpret the no-arbitrage value of interest rate for equity swaps.

Describe swaptions.

Calculate the no-arbitrage value of a European option at a node.

Interpret components of the BSM model as applied to call options in terms of the stock price and strike price at expiration (most common).

Describe the value of a call and a put.

The value of a call includes the intrinsic value and a time value. The intrinsic value is:

cT = Max[0,(ST−X)]

pT = Max[0,X−ST]

Describe the value of a call and a put. Identify put call parity equations.

The put-call parity equations are:

c + PV(X) = p + S

∴

p = c + PV(X) − S

Describe and interpret the binomial option valuation model.

The model is a lattice-based (discrete time) process for finding the probabilistic option value from each previous step given up or down values. Calculations assume a no-arbitrage approach between the option value and h shares of stock plus financing.

At each node, option value can increase by some factor u or down by some factor d equal to (1 + %Δ).

Describe floating-for-floating currency swaps.

Describe the BSM model is used to value European options on equities and currencies.

Identify the statistical process assumptions of the Black-Scholes-Merton option valuation model.

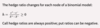

Describe the hedge ratio used to calculate the value of a European option using the binomial valuation model.

The hedge ratio h identifies the percentage of a call with price c required to offset movements in the underlying share of stock with price S. Call prices are related to movements in the underlying, so h must be non-negative. Put ratios may be negative.

Define implied volatility and explain how it is used in options trading.

Describe and compare how interest rate and equity swaps are priced and valued.

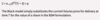

Calculate the risk neutral probability of an up or down move.

Describe how the Black model is used to value European swaptions.

The Black model determines the present value of the swaps, and then discounts them for the period until option expiry.

Interpret components of the BSM model as applied to call options in terms of a leveraged position in the underlying (alternative).

Interpret option measure theta.

Calculate and interpret the no-arbitrage value of equity, interest rate, fixed income, and currency forward and futures contracts.

(Short version)

Describe how a delta hedge is executed.

(Math version)

Describe the arbitrage possibilities if the no-arbitrage pricing framework is violated.

Explain the components of the Black model in terms of a leveraged position in the underlying.

Calculate the no-arbitrage value of a European option using a two-period binomial model.