REG - Final Review Flashcards

(216 cards)

What is a CFC?

Controlled foreign coporation

U.S. shareholders owns 50% or more of it’s stock, in aggregate

and

U.S. person owns at least 10%, individually

What is PFIC?

Passive Foreign Investment Company

75% or more of gross income is passive

or

50% or more of total assets are passive

What is the GILTI tax?

Global Intangible Low-Taxed Income

It’s a minimum tax that must be paid by CFCs on Subpart F income.

How is the GILTI tax calculated?

- Calculate GILTI income

- CFC net income minus 10% avg. adjusted basis in tangible property

- Multiply the amount above by % owned by U.S. person

- Subtract GILTI deduction if U.S. corporation

- GILTI income times 50%

What is a large U.S. corporation under BEAT (Base Erosion and Anti-Abuse Tax)?

Annual gross receipts $500 million or more

What is the BEAT tax?

A miminum tax on large U.S. corporations with significant deductible payments to related foreign affiliates.

What is considered significant deductible payments to related foreign affliliates according to the BEAT tax?

3% or higher of total deductions

What is the substantial presence test?

A foreign person is considered a U.S. resident if:

- Present at least 31 days in the current year; and

- Present at least 183 days for a 3-year period, applying a weighted average:

What is the criteria for an individual to qualify for the mark-to-market regime?

- Renounce U.S. citizenship; and

- Meet 1 of the tests below:

- Tax liability Test

- Net worth Test

- Compliance Test

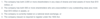

What is the tax liability test?

What is the net worth test?

What is the compliance test?

What is foreign-derived intangible income?

Sales to non-U.S. person of property for use outside the U.S.

What is FDAP?

Fixed, Determinable, Annual or Periodic Income

It’s a withholding on a foreign persons’ investment income.

What is FATCA?

Foreign Account Tax Compliance Act

Withholds tax for foreign entities that do not provide info to U.S. receipients

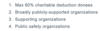

Who is eligible for the 100% dividends received deduction?

Dividends paid by a foreign corporation to U.S. corporation owning 10% or more of stock

How is the increase in earnings invested in U.S. property calculated?

The average adjusted basis of CFC property (use quarterly figures)

minus

The adjusted basis at the end of the preceding year

What are the requirements to qualify as a S corp?

- Qualified corporation

- Eligible shareholder

- Individual, estate, or trust

- U.S. citizen (resident)

- 100 shareholders limit

- 1 class of stock

What are the requirements for an S corp contribution to be tax-free?

- Must be property;

- Soley in exchange for stock; and

- Shareholder(s) control 80% or more of stock

What taxes may a S corp be required to pay?

If S corp transitions from a C corp:

- LIFO recapture tax

- Built-in gains tax

- Tax on passive investment income

How does an S corp become exempt from the built-in gain tax?

- Never was a C corp

- Sale or transfer of property happens 5 years after S election

- Appreciation of asset happen after S election

- Assets acquired after S election

- Gain recognized in prior years

When is an S corp taxed on passive investment income?

- Has prior accumulated C corp earnings

- Passive income exceeds 25% of gross receipts

What is the ordering rule for calculating the stock basis in an S corp?

When does the S election take effect?

If elected by March 15 then the election would take effect January 1 of the current year.

If not, then the election would take effect January 1 of the next year.