Quantitative Methods: Basic Concepts Flashcards

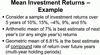

TVM: Interpreting Interest Rates (3)

- Equilibrium interest rates are required rate of return for a particular investment

- Interest rates also known as discount rates

- Interest rates are the opportunity cost of current consumption because future consumption could be i% higher

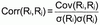

TVM: Components of Interest Rates

Required (nominal) interest rate on a security=

TVM: Effective Annual Rates - Examples (3)

Stated Annual Rate is 12%

TVM: TVM - Example (2)

TVM: PV of a Perpetuity - Example

Preferred stock pays $8/year forever, with 10% rate of return. What is it’s present value?

TVM: FV of Single Sum

FV of $200 invested for 2 years at 10% interest rate

TVM: PV of a Single Sum - Example

PV of $200 in 2 years at 10% interest

TVM: PV of an Ordinary Annuity

PV of $200, received each year, for 3 years, at 10% interest rate

FV of an Ordinary Annuity

What is the value in three years of $200 to be received at the end of each year for three years when interest rate is 10%

TVM: PV of Annuity Due

PV of $200 received at the start of each year, for 3 years at 10%

TVM: FV of Annuity Due

FV of $200 received at beginning of each year for 3 years at 10% interest

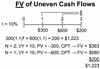

TVM: FV of Uneven Cash Flows

PV of $300 received 1st year, $600 received 2nd year, and $200 received 3rd year at 10% interest

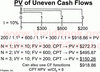

TVM: PV of Uneven Cash Flows

PV of $300 received 1st year, $600 received 2nd year, and $200 received 3rd year at 10% interest

TVM: Mortgage Example

- Month Payment on $100K, 30-year home loan at 6% stated rate N=30y x 12m = 360 payments, I = 6%/ 12m= .5 I/Y

PV= 100,000; FV = 0; CPT –>PMT = -599.55

- Remaining principle after 85 payments

N = 360 - 85 = 275 payments left CPT –> PV = 89,488

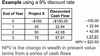

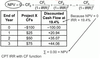

DCF: NPV

Net present value: the sum of present values of a series of cash flows

DCF: IRR

- Internal rate of return: IRR is the discount rate that equates the PV of a series of cash flows to their cost

- The IRR is the discount rate that makes NPV = 0

- Possible Problems with IRR:

- When a series of cash flows goes from negative to positive, then back to negative again, there can be more than one IRR

- Series of csh flows can be ranked by their NPVs, but IRR rankings can differ

DCF: Holding Period Return: Example

DCF: Time-Weighted Returns

Annual time-weighted returns are effective annual compound returns

DCF: Money-Weighted Returns

- Money-weighted returns are like an IRR measure

- Periods must be equal length, use shortest period with no significant cash flows

DCF: BDY, HPY, EAY, MMY

DCF: Yield Example

DCF: BEY

Bond Equivalent Yield is 2x the effective semi-annual yield

Statistics: Basic Terms (7)

- Descriptive Statistics- describes properties of a large data set

- Inferential Statistics- use a sample from a population to make probabilistic statements about the characteristics of population

- Population- a complete set of outcomes

- Sample- a subset of outcomes drawn from a population

- Parameter- describes a characteristic of a population

- Sample Statistic- describes a characteristic of a sample (drawn from a population

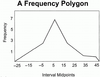

- Frequency Distribution- a table that summarizes a large data set by assigning the observations to intervals

Statistics: Measurement Scales (NOIR) (4)

- Nominal- Only names make sense (eg. Parrot, robin, seagull)

- Ordinal- Order makes sense (eg. large-cap, mid-cap, small-cap)

- Interval- Intervals make sense (eg. 40F is 10* greater than 30F)

- Ratio- Ratios make sense (abs zero) (eg. 200 is 2x as $100)