Final Exam Flashcards

On January 1, 2011, Anderson Company purchased 40% of the voting common stock of Barney Company for $2,000,000, which approximated book value. During 2011, Barney paid dividends of $30,000 and reported a net loss of $70,000. What is the balance in the investment account on December 31, 2011?

2,000,000 + ((-70,000 - 30,000) x 40% ) = 1,960,000

On January 1, 2011, Anderson Company purchased 40% of the voting common stock of Barney Company for $2,000,000, which approximated book value. During 2011, Barney paid dividends of $30,000 and reported a net loss of $70,000. What amount of equity income would Anderson recognize in 2011 from its ownership interest in Barney?

-70,000 x 40% = -28,000 Dr.: equity in earnings 28,000 Cr.: Investment 28,000

Journal entries for the fair value option to recognize investment and dividend income

Dr.: Cash xx Cr.: Dividend income xx Dr.: Investment xx Cr.: Investment income xx (fair value increase)

What amount will be reported for consolidated retained earnings?

1,080-15 = 1,065

Dr.: service expense 15

Cr.: cash 15

Macek’s equity balances are eliminated through Entry S

What amount will be reported for consolidated additional paid-in capital?

200 + 160 - 10 = 350

Dr.: investment 760

Cr.: cash 400

Cr.: common stock 200

Cr.: APIC 160

Dr.: APIC 10

Cr.: cash 10

What amount will be reported for consolidated common stock?

1,000 + 200 = 1,200

Consolidated: Receivables, Inventory, Land?

receivables: 480 + 160 = 640

inventory: 660 + 300 = 960

land: 300 + 130 = 430

The fair value of identifiable net assets excluding goodwill of a reporting unit of Y Company is 630,000. On Y Company’s books, the carrying value of this reporting unit’s net assets is $700,000, including $60,000 goodwill.

If the fair value of the reporting unit is $650,000, what amount of the impairment loss that will be reported for this unit after the impairment test?

What amount of goodwill will be reported for this unit after the impairment test ?

Impairment Loss: 60,000 - 20,000 = 40,000

Goodwill: 650,000 - 630,000 = 20,000

X Co. acquired 70% of the common stock of Y Corp. for $1,400,000. The fair value of Y’s net assets was $1,200,000, and the book value was $950,000. The non-controlling interest shares of Y are not actively traded.

What amount of goodwill should be attributed to X and Y at the date of acquisition?

Denber Co. acquired 60% of the common stock of Kailey Corp. on January 1, 2010. For 2010, Kailey reported revenues of $810,000 and expenses of $630,000. The annual amount of amortization related to this acquisition was $15,000.

What is the amount of the non-controlling interest’s share of Denber’s income for 2010?

(810,000 - 630,000 - 15,000) x 0.4 = 66,000

Denber Co. acquired 60% of the common stock of Kailey Corp. on January 1, 2010. For 2010, Kailey reported revenues of $810,000 and expenses of $630,000. The annual amount of amortization related to this acquisition was $15,000.

What is the controlling interest’s share of Denber’s income for 2010?

(810,000 - 630,000 - 15,000) x 0.6 = 99,000

(equal to equity in subsidiary income when the equity method is used)

On January 1, 2010, Jannison Inc. acquired 90% of Techron Co. by paying $477,000 cash. There is no active trading market for Techron stock. Techron Co. reported a Common Stock account balance of $140,000 and Retained Earnings of $280,000 at that date. The fair value of Techron Co. was appraised at $530,000. The total annual amortization was $11,000 as a result of this transaction. The subsidiary earned $98,000 in 2010 and $126,000 in 2011 with dividend payments of $42,000 each year.

Without regard for this investment, Jannison had income of $308,000 in 2010 and $364,000 in 2011. What is the consolidated net income for 2010?

Compute the non-controlling interest in the net income of Demers at December 31, 2010

Net Income: (100,000 - 7,000) x 0.2 = 18,600

Amortization expense= (30,000 / 10) + (40,000 / 10) = 7,000

Compute the non-controlling interest in Demers at January 1, 2010.

(500,000 / 0.8) x 0.2 = 625,000 x 0.2 = 125,000

Compute the non-controlling interest in Demers at December 31, 2010

Noncontrolling interest on January 1, 2010: 125,000*

Noncontrolling interest in Sub’s income: 18,600

Noncontrolling interest in Sub’s dividend: (8,000**)

Noncontrolling interest on December 31, 2010: 135,600

*(500,000/0.8) x 0.2=625,000 x 0.2=125,000

**40,000 x 0.2

Journal Entry S?

Dr.: Common Stock 300,000

Dr.: Retained Earnings 210,000

Cr. Investment in Demers (0.8 x 510,000): 408,000

Cr. Noncontrolling interest (0.2 x 510,000): 102,000

Journal Entry A?

Dr.: Equipment 30,000

Dr.: Building 40,000

Dr.: Goodwill 45,000 (500K / 0.8 - (300K + 210K + 30K + 40K))

Cr.: Investment in Demers (0.8 x 115,000) 92,000

Cr.: Noncontrolling interest (0.2 x 115,000) 23,000

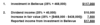

Compute the investment balance of Pell Company at December 31, 2010.

Consideration transferred (initial investment): $500,000

Increase in net income: $74,400*

Decrease in dividends received: ($32,000**)

Pell’s investment in Demers on December 31, 2010: $542,400

* (100,000-7,000) x 0.8

** 40,000 x 0.8

Noncontrolling interest in consolidated income when the selling affiliate is an 80% owned subsidiary is calculated by?

(subsidiary’s net income – excess amortization expense - unrealized profit in ending inventory + realized profit in beginning inventory) x 20%

Noncontrolling interest in consolidated income when the selling affiliate is a parent is calculated by?

(subsidiary’s net income – excess amortization expense) x 20%

Consolidated sales for 2011?

Sales to outside parties: 165,000

Dr.: Sale 140,000 (Seller-Sub.)

Cr.: COGS 140,000 (Buyer-Parent)

Unrealized intra-entity gross profit in ending inventory that should be eliminated in the consolidation process for 2011?

Gross Profit Rate = 21%

Ending Inventory = 140,000 x 0.4 = 56,000

Answer: 56,000 x 0.21 = 11,760

Dr.: COGS (Buyer-Parent) 11,760

Cr.: Inventory (Buyer-Parent) 11,760

COGS for 2011?

84,000 + 110,000 - 140,000 + 11,760* = 65,760

*Unrealized intra-entity gross profit in ending inventory:

(140,000 x 0.4) x 0.21 = 11,760

Dr.: COGS (Buyer-Parent) 11,760

Cr.: Inventory (Buyer-Parent) 11,760

Walton Corporation owns 70% of the outstanding stock of Hastings. On January 1, 2011, Walton acquired a building with a 10-year life for $300,000. Walton anticipated no salvage value, and building was to be depreciated on the straight-line basis. On January 1, 2013, Walton sold this building to Hastings for $280,000. At that time, the building has a remaining life of eight years, but still no expected salvage value.

What is the gain or loss on equipment reported by Walton for 2013?

Transfer Price: 280,000

Book Value: 240,000*

Unrealized Gain = 40,000

*300,000 - (30,000 x 2) = 240,000